Diminishing value method of depreciation formula

The following formula calculates depreciation amounts. Depreciation Original cost Residual Value x.

Written Down Value Method Of Depreciation Calculation

The two methods can.

. 2000 - 500 x 30 percent 450 Year 2. For the second year the depreciation charge will be made on the diminished value ie Rs 90000 and it will be 90000 10 R s 9000 Now the value of the. Depreciation x Actual output during the year units Sum of Years of Digits method It is a variant of the diminishing balance method.

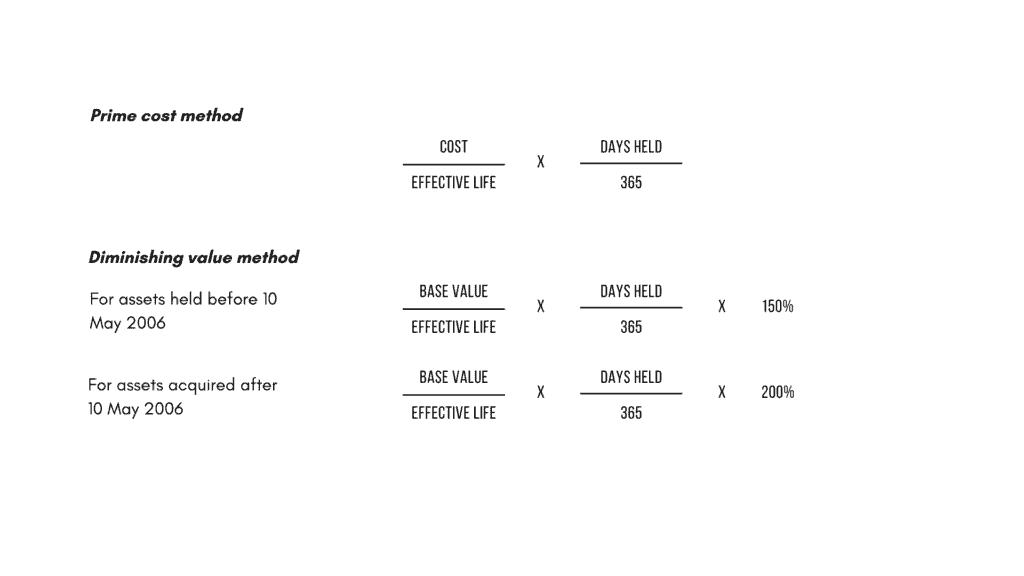

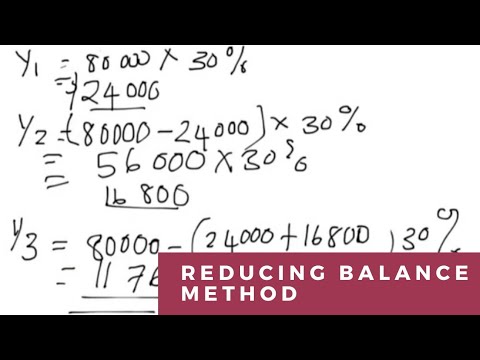

In this video we use the diminishing value method to calculate depreciation. Base value days held 365 150 assets effective life Reduction for. Formula to Calculate Depreciation Value via Diminishing Balance Method.

Here are the steps for the double declining balance method. Diminishing Value Depreciation Method. The diminishing value formula is as follows.

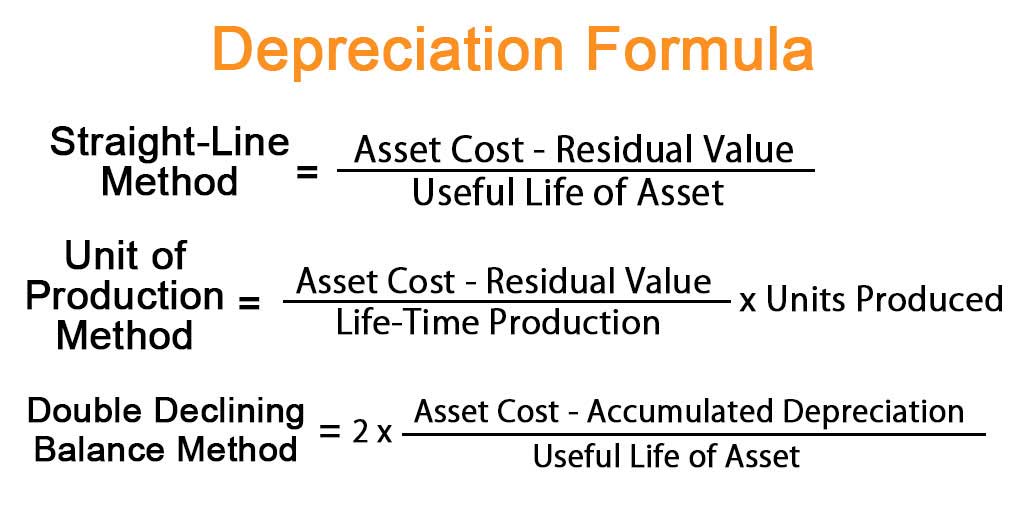

The formula for prime cost depreciation method is assets cost x days held 365 x 100 assets effective life. Lets understand the same with the help of examples. The most widely accepted method for calculating diminished value is the 17c formula.

Depreciation Amount Declining-Bal. Subtract the depreciation cost from the assets current book. Calculate the depreciation expense using the following formula.

1 Scrap ValueAsset Value 1Life Span In. Declining Balance Method Example. Under the straight-line depreciation method the company would deduct 2700 per year for 10 yearsthat is 30000 minus 3000 divided by 10.

X Number of Depreciation Days x Depr. Diminishing value method Another common method of depreciation is the diminishing value method. TextAmount of depreciation frac textBook Value times textRate of Depreciation 100 2015.

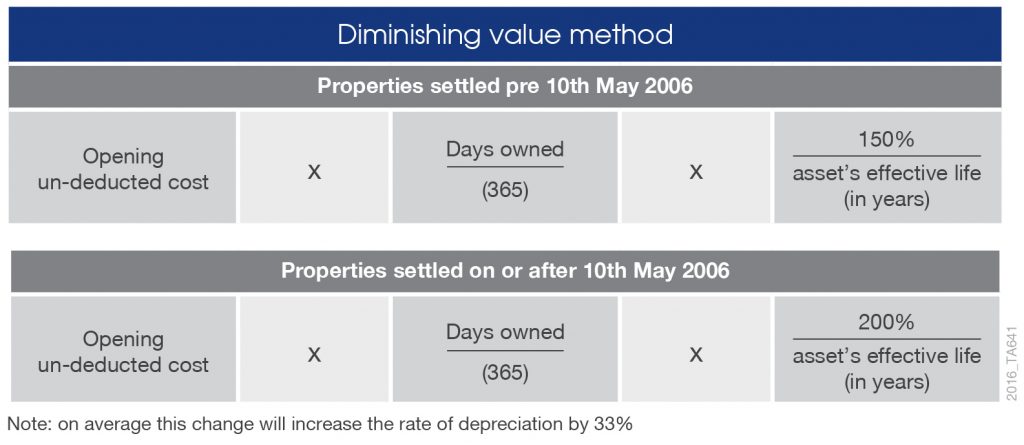

Depreciation 500000 x 10100 x 912 37500. We already depreciated our car by 600 in the first year above. Base value x days held 365 x 200 assets effective life Example.

Now lets work through a diminishing value calculation. Depreciation Rate Book Value Salvage Value x Depreciation Rate The diminishing balance method of. The two methods can be understood with an example.

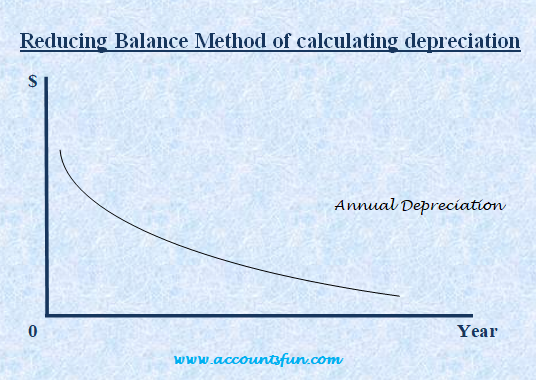

With the diminishing balance method depreciation is calculated as a percentage on the book value. In this video we use the diminishing value method to calculate depreciation. Hence using the diminishing method.

Cost value diminishing value rate amount of depreciation to claim in your income tax return The assets new adjusted tax value is its cost value minus how much depreciation. You might need this in your mathematics class when youre looking at geometric s. Ram purchased a Machinery costing 11000 with a useful life of 10 years and a.

Year 2 2000 400 1600 x. Net Book Value - Scrap. Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense.

Year 1 2000 x 20 400. Depreciation per year Book value Depreciation rate. Basis 100 x 360 The depreciable.

Base value days held see note. The formula for the diminishing balance method of depreciation is. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows.

Hereof How do you calculate diminished value depreciation. The formula for determining depreciation value using the declining balance method is-Depreciation.

Depreciation Diminishing Value Method Youtube

Working From Home During Covid 19 Tax Deductions Guided Investor

How To Calculate Depreciation Using The Reducing Balance Method Diminishing Balance Method Youtube

Declining Balance Method Of Depreciation Formula Depreciation Guru

Depreciation Formula Calculate Depreciation Expense

Prime Cost Vs Diminishing Value Depreciation Method Which Is Better Duo Tax Quantity Surveyors

Depreciation Diminishing Balance Method Youtube

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

Diminishing Balance Method Of Calculating Depreciation Also Known As Reducing Balance Method Accounting Simpler Enjoy It

A Complete Guide To Residual Value

Solved I M Trying To Calculate For The Diminishing Rate On Chegg Com

Diminishing Value Vs The Prime Cost Method By Mortgage House

Written Down Value Method Of Depreciation Calculation

Straight Line Method Vs Diminishing Balance Method Depreciation Calculation Examples Youtube

Written Down Value Method Of Depreciation Calculation

Straight Line Vs Reducing Balance Depreciation Youtube

Accounting Practices 501 Chapter 9 Ppt Video Online Download