Inherited ira required minimum distribution calculator

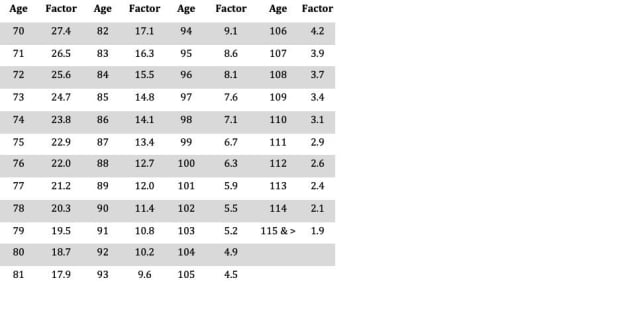

Determine the required distributions from an inherited IRA The IRS has published new Life Expectancy figures effective 112022. Ad Inherited an IRA.

Required Minimum Ira Distributions Tax Pro Plus

Ad Learn more about Fisher Investments advice regarding IRAs taxable income in retirement.

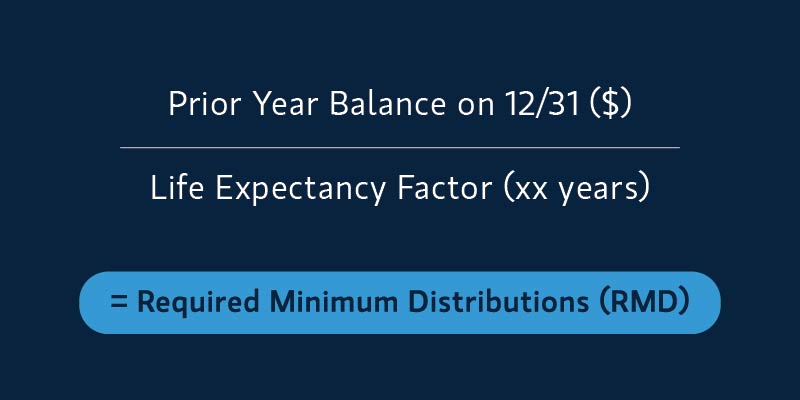

. Schwab Can Help You Through The Process. Ad Use This Calculator to Determine Your Required Minimum Distribution. The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

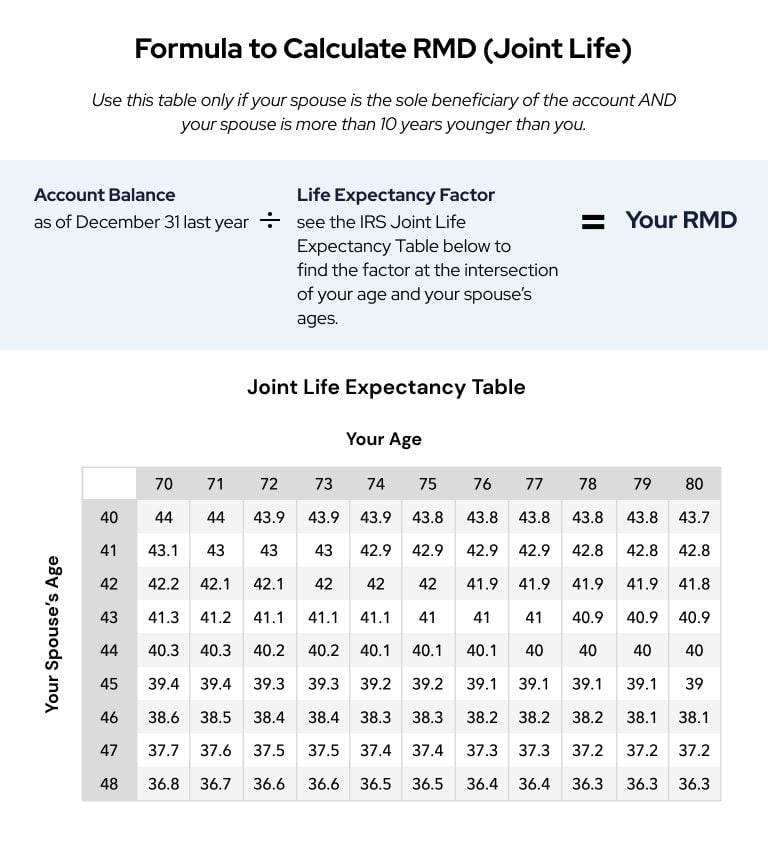

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. 36 rows aka Minimum Required Distribution Calculator This calculator determines the minimum required distribution known as both RMD or MRD which is really confusing from. If you move your money into an inherited IRA you withdraw RMDs based on your age.

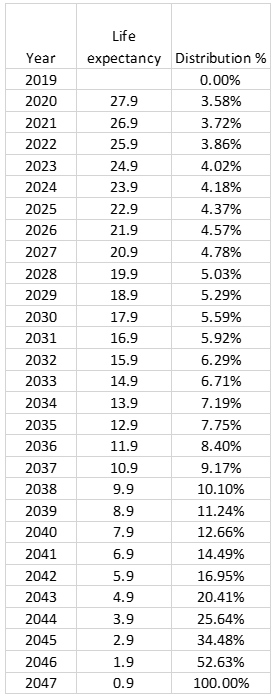

This calculator has been updated to reflect the new. If you have inherited a retirement account generally you must withdraw money from the account in accordance with IRS rules. Account balance as of December 31 2021 7000000.

This calculator has been updated for the SECURE Act of 2019 and CARES. Learn More About Inherited IRAs. A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year.

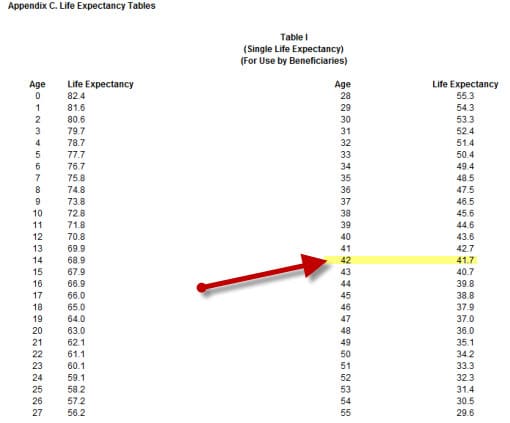

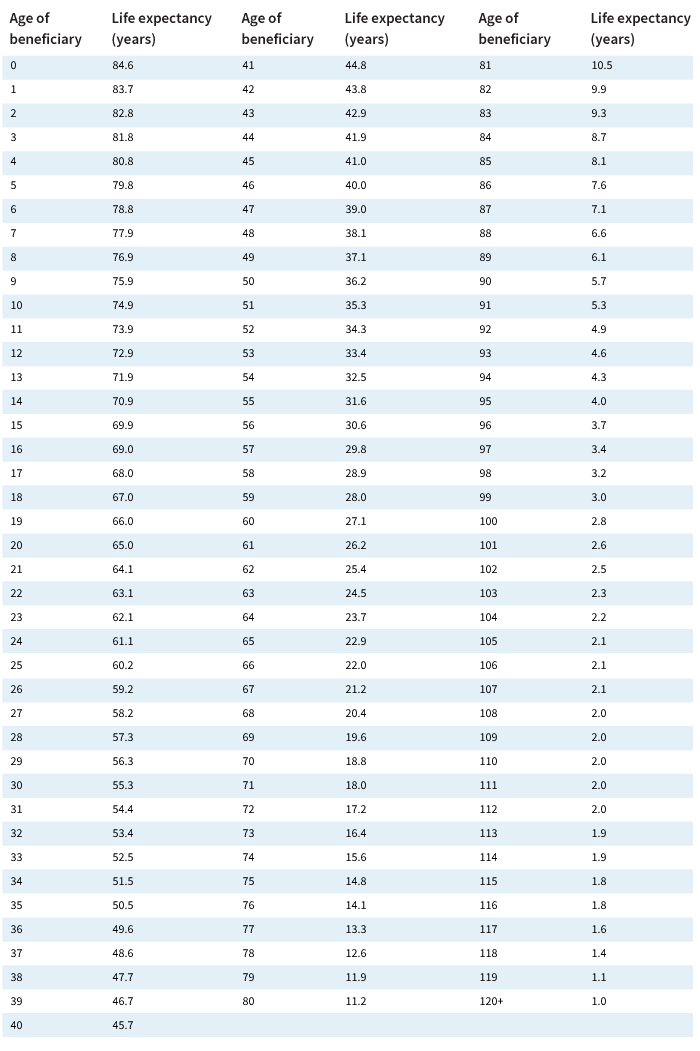

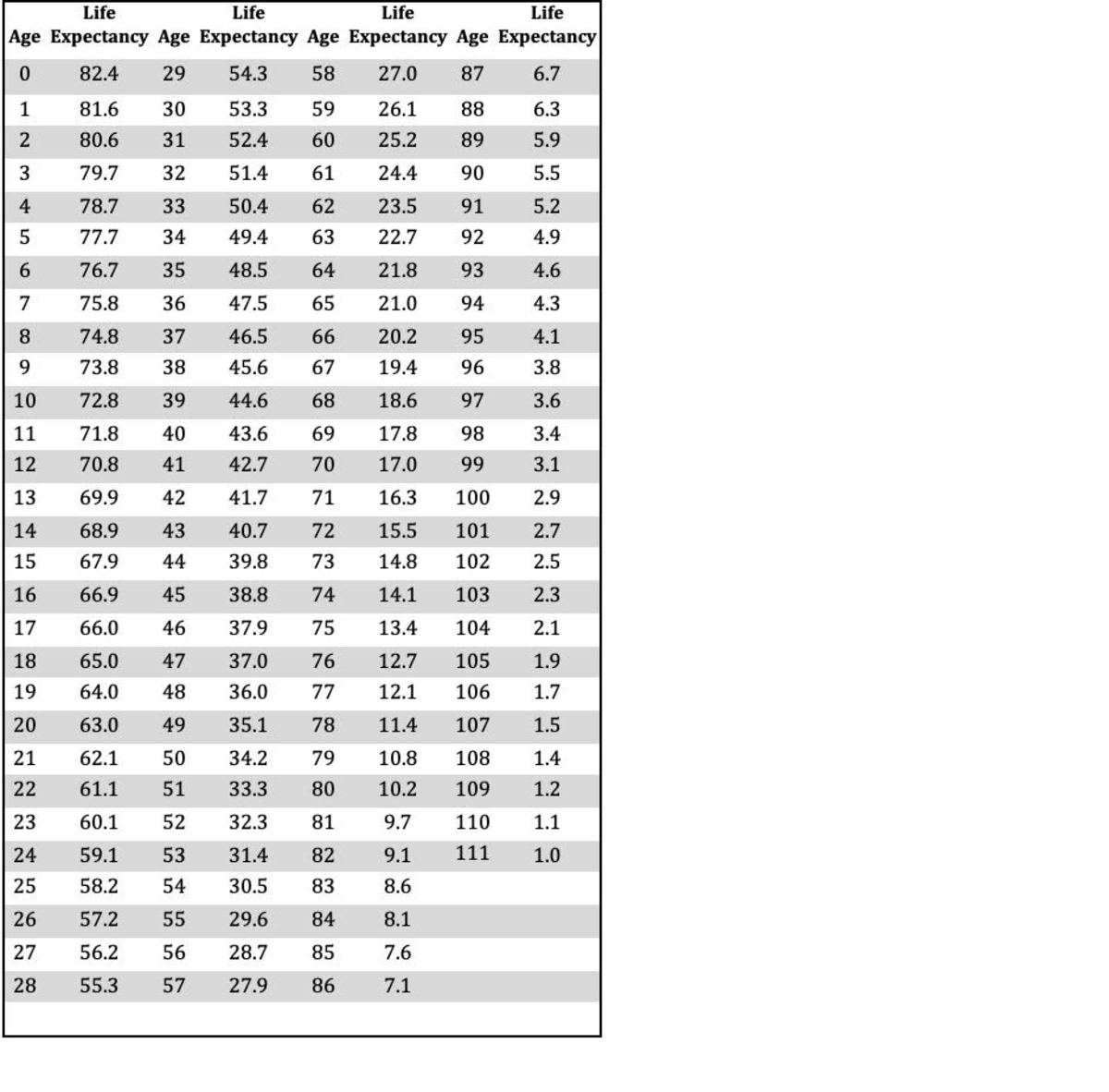

The SECURE Act of 2019 changed the age that RMDs must begin. Distribute using Table I. Deadline for receiving required minimum distribution.

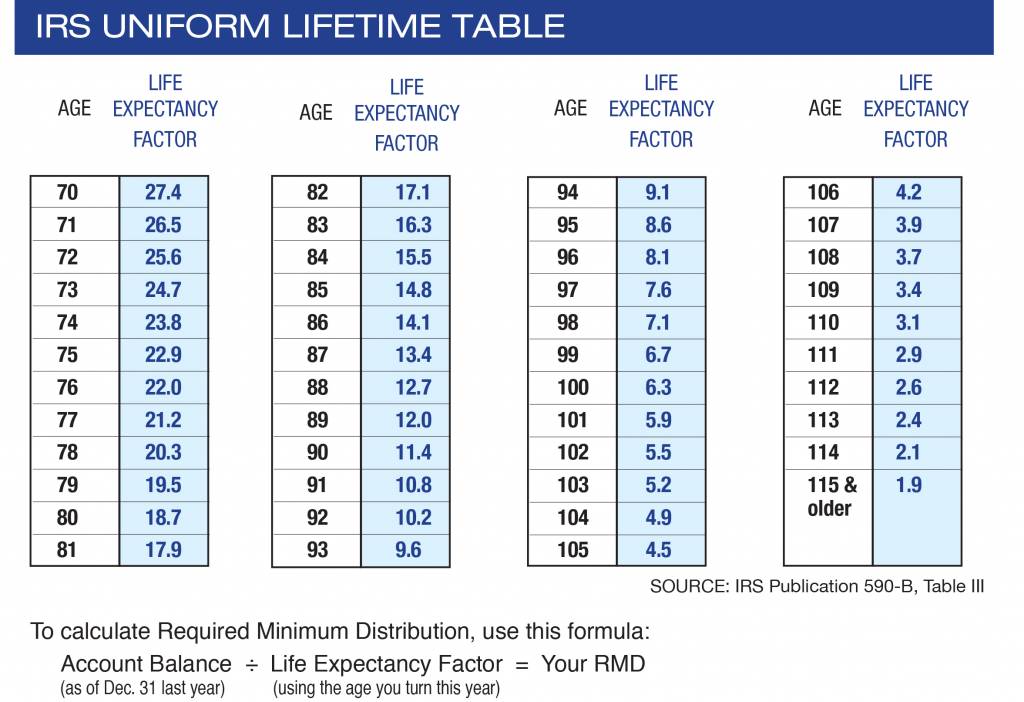

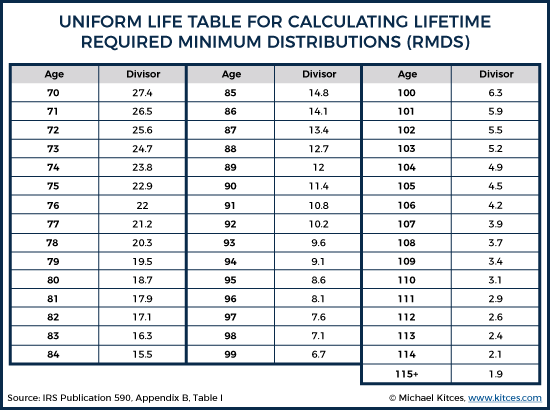

Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. If you want to simply take your inherited money right now and pay taxes you can. In 2019 congress changed the rules for required minimum distributions rmds from inherited individual retirement account ira and employer-sponsored account balance.

Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year. RMD amounts are based on your age and are recalculated each year based on factors in the IRS. But if you want to defer taxes as long as possible there are certain distribution requirements with which you.

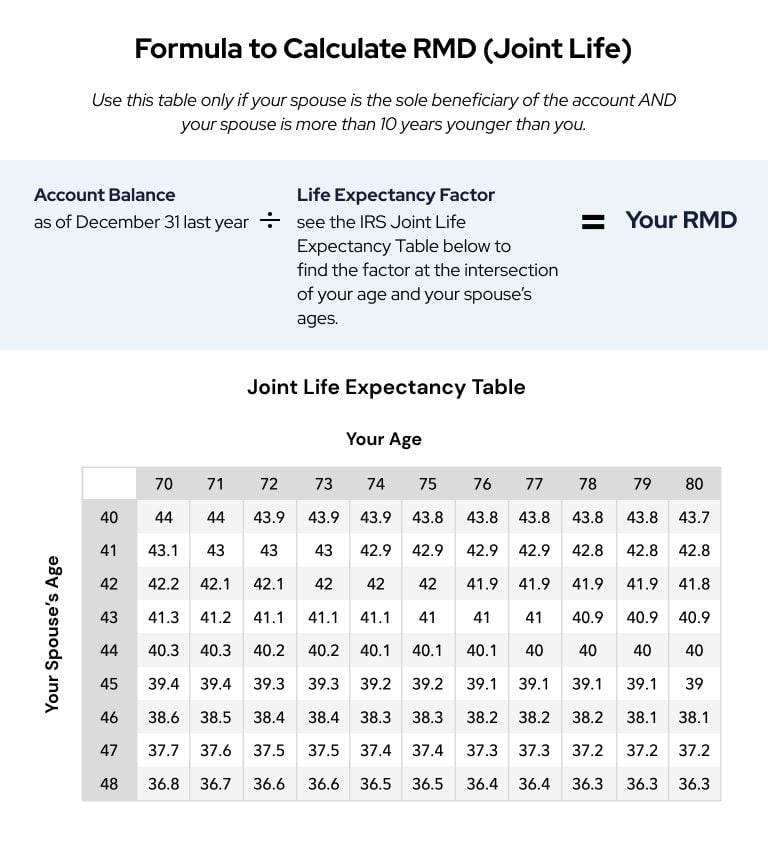

Yes Spouses date of birth Your Required Minimum Distribution this year is 0 How is my RMD calculated. Starting the year you turn age 70-12. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

The year to calculate the Required Minimum Distribution RMD. The first will still have to be taken by April 1. This is typically the current year.

Use this calculator to determine your Required Minimum Distributions RMD as a beneficiary of a retirement account. How is my RMD calculated. You can also explore your IRA beneficiary withdrawal options based on.

You can also explore your IRA beneficiary withdrawal options based. The second by December 31. These amounts are often called required minimum distributions.

Paying taxes on early distributions from your IRA could be costly to your retirement. Enjoy Tax-Deferred Growth No Early Withdrawal Penalty When You Open An Inherited IRA. Determine beneficiarys age at year-end following year of owners.

Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. Note that if you delay your first RMD until April youll have to take 2 RMDs your first year. Year you turn age 72 70 ½ if you reached 70 ½ before January 1 2020 - by April 1 of the following year All subsequent years - by.

Change the year to calculate a previous years RMD. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. An april 1 withdrawal for the year.

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. For the first year following the year you reach age 70½ age 72 if born after june 30 1949 you will generally have two required distribution dates. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. Use our Inherited IRA calculator to find out if when and how much you may need to take depending on your age. Beneficiarys name Please enter the.

If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from an account each year to avoid IRS penalties.

The Inherited Ira Portfolio Seeking Alpha

Ira Required Minimum Distribution Table Sound Retirement Planning

Required Minimum Distributions Rules Heintzelman Accounting Services

Sjcomeup Com Rmd Distribution Table

Rmd Table Rules Requirements By Account Type

Ira Withdrawal Calculator Store 57 Off Www Ingeniovirtual Com

Rmd Tables

Required Distributions On Inherited Retirement Accounts Reduced In 2022 Putnam Wealth Management

Required Minimum Distribution Calculator

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

Sjcomeup Com Rmd Distribution Table

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Table Rules Requirements By Account Type

Sjcomeup Com Rmd Distribution Table

Required Minimum Distributions For Retirement Morgan Stanley

Rmd Tables

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More